Fill & Sign Forms-Adobe Acrobat DC

Fill and Sign PDF Forms Open the PDF that you want to fill in and sign using Adobe Acrobat DC. Click the Fill & Sign tool located in the right hand pane. Click in a field and start typing.Adobe may suggest responses based upon previously entered data or stored...

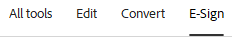

Let’s Get Rid of =GetPivotData

=GetPivotData If you use pivot tables a lot, then you have run into the GetPivotData formula. The other day, I was trying to create a formula referencing some pivot table cells and the GetPivotData formula popped up when I did not want it to. Today, I read Debra...

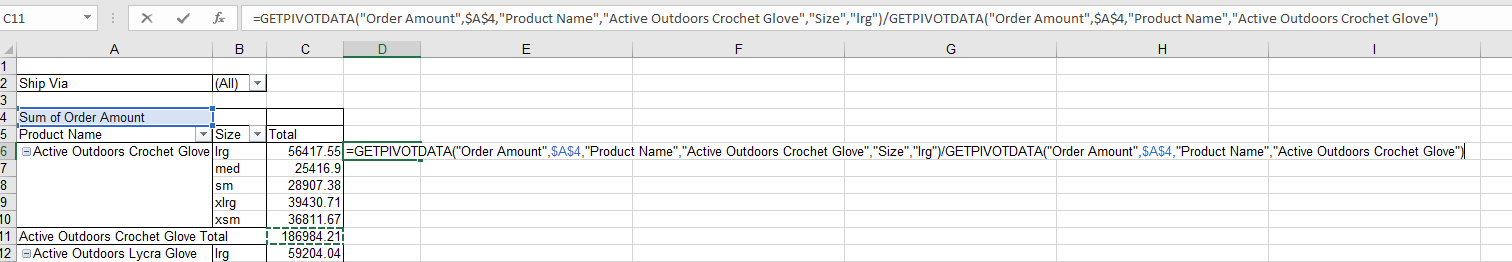

Adding VLookup as a Control for Your Month-End Workpapers

VLOOKUP As a CONTROL When closing for the month, many use an Excel workbook to reconcile balances to the general ledger. As the general ledger changes, do you have a process in place to easily determine that balances previously reconciled still tie to the general...

Economic Nexus – South Dakota Supreme Court Case

Economic Nexus Update: Looks like many states are now moving forward with out-of-state sales tax. My guess is that many states are going to set minimum revenue amounts so the small entrepreneurs and small EBay sellers won’t be impacted. Let’s hope....