3 Most Common Financial Reporting Errors

Three Most Common Reasons for Restating Financial Statements I just finished reading an interesting article in the Wall Street Journal on financial reporting. Did you know that over 650 companies filed financial revisions or restatements last year? In most cases, it...

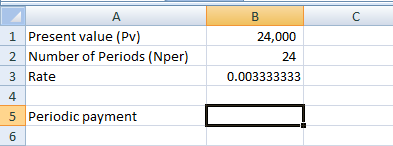

Computing a Loan Payment & Creating an Amortization Schedule

Computing the Periodic Payment for a Loan Excel Financial Function Computing the periodic payment is probably the most used Excel financial function simply because it is something everyone uses.Let’s walk through an example.You want to purchase a car and finance...

Dupont Model

Dupont Model The DuPont Model is a methodology that computes Return on Equity by component parts. Business owners and shareholders are very interested in their level of return. A method of consulting with business owners and shareholders on ways to boost Return on...